Creating a budget is an essential step towards financial stability and success. Budgets help you manage your money more effectively and reduce your debts. But most importantly, they clear the path to your financial goals by illuminating what’s really important to you.

However, creating a budget is not enough; sticking to it is equally crucial. Budgets that you hate creating are going to be difficult to follow. In this post, I will help you create a budget you will actually follow in five steps.

1. Determine your income and expenses

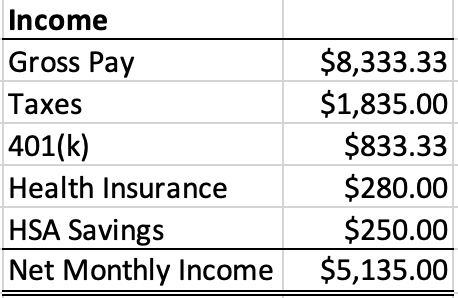

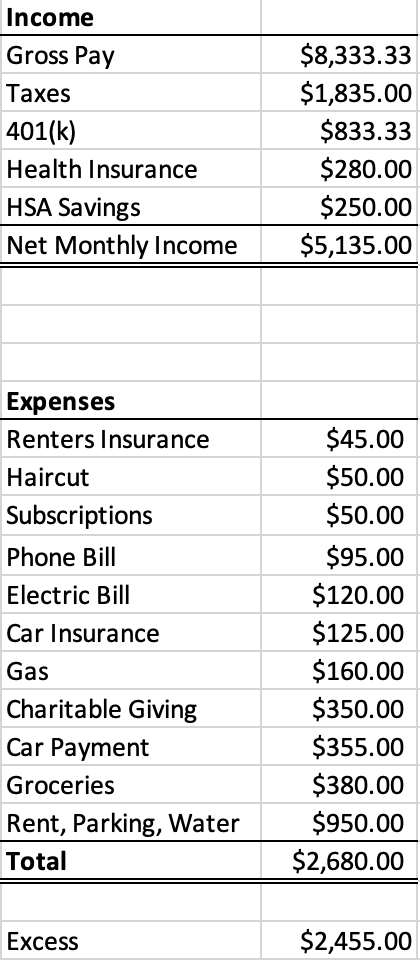

You knew this one was coming. Start by calculating your monthly income, including your salary, bonuses, and any other sources of income. Take your gross amount and subtract the taxes, health insurance premiums, retirement account contributions, and any other deductions until you derive the exact number that hits your bank account on payday.

Next, divide this by 12. This is your monthly net income. In this example, the client earns $100,000 per year.

Contrary to most budgeting advice, for this next step I only want you to account for expenses that you know without a doubt are coming each month. This includes your mortgage/rent, debt payments, utilities, subscriptions like Spotify and Netflix, charitable giving, etc. These should all be fixed amounts.

Also do your best to estimate variable amounts such as groceries and gas for your car. This does NOT include dining out, new clothes, or any other frills. Just the essentials to get by.

Now subtract your fixed and essential variable expenses from your monthly take-home pay. This is your excess (hopefully, at least).

2. Set financial goals with your excess

The next step is where it gets fun. Setting financial goals is an essential part of creating your budget. Your budget is meant to set you free, not constrain you. A budget gives you clarity on possible goals. It can motivate you to save money and help you track your progress.

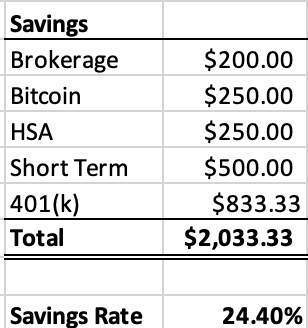

Ideally, you’re able to save at least 20% of your PRE-TAX income for these goals. If your annual income is $100,000, saving $20,000 this year should be your aim.

This isn’t possible for everyone, and I sympathize with those that can’t make it work. But this should be your goal and maybe it’s something you can strive towards over time. If it isn’t possible for you, consider working with a financial planner so that it can become attainable.

If you have retirement account and/or HSA contributions being deducted from your gross pay, be sure to include those in your savings rate.

I want you to strive for a 75/25 split in your savings:

- 75% is long-term savings that you won’t touch for at least 10 years.

- This money is for retirement, mainly. But also taxable brokerage accounts that you can access beforehand if needed, but no plans to do so.

- The remaining 25% is more like 5 years or less.

- I’m a huge advocate of saving money each paycheck for Christmas gifts, as an example. Other possibilities include vacations, maybe a business venture you want to explore, annual insurance premiums, extra tax cushion, or anything else you need to save for.

In this example, the client has a pre-tax savings rate of 24.4% ($2,033.33 monthly savings divided by gross pay of $8,333.33).

The Brokerage, Bitcoin, HSA, and 401(k) investments are all considered long-term. The client has a 75/25 long term/short term savings split.

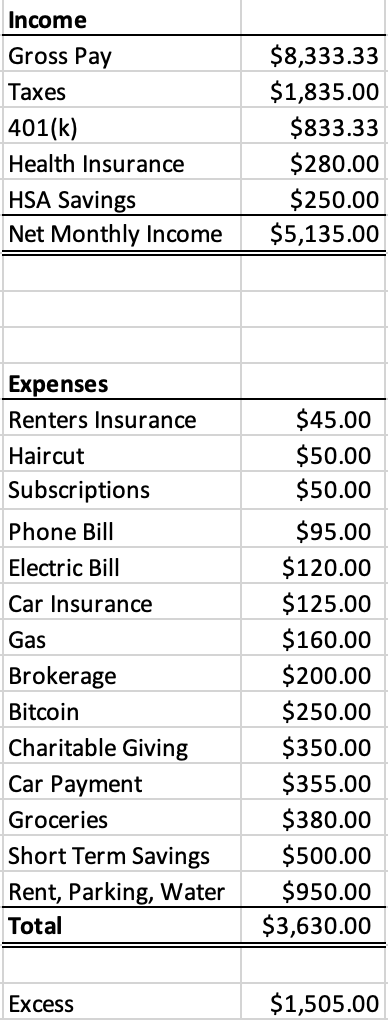

3. Incorporate these goals back into your budget.

Now that these monthly savings goals are established, return to Step 1, and add them into your budget. These should now be viewed as fixed expenses that you know are coming every month. Automate them. Get used to living without that money. Treat it as a priority.

4. Spend your excess number’s excess freely

Now you have another excess number. This number is your fun money. Use it on whatever you want and do so freely. If you want to save even more, more power to ya! That is music to a financial planner’s ears.

The important part about developing a budget is determining realistic savings goals. Then you must be strict with these goals. But once those are satisfied, there’s no reason for you to feel guilty about your expenditures.

This is where I’ll differ from other advisors like Dave Ramsey, for example. I don’t believe that you should limit your dining out to $100/month, your entertainment to $200/month and so on. You’re tracking enough as it is – no need to get hyper-specific. And I actually encourage you to have fun money expenditures. You only have one life to live. Enjoy it!

This doesn’t mean to throw around money willy nilly, either. Yes, the more you can save, the better. If you find yourself spending an amount not even close to your excess, increase your savings goals. Your future self will thank you.

5. Revisit your budget when needed

As your life progresses, your income and expenses will likely change since the first time you established a budget. I recommend reviewing your budget twice each year at a minimum.

Maybe you earned a raise or added a monthly subscription recently. Update your budget to reflect this so you can avoid surprises.

You especially need to review your budget if you experience a pay increase. If your savings goals don’t change, your savings rate of 20% will fall. This is very important to remember!

Conclusion

Your new budget has liberated you. You now have solid goals set and a process to review them. Also, you now have a dollar amount that you know you can spend on whatever your heart desires every month.

My hope is that implementing a budget process like this is more of a freeing experience than a constraining one. Hardly anyone likes establishing and reviewing budgets – I get it. However, a well-balanced budget is one of the most vital parts of a successful financial plan.

Trent is a CERTIFIED FINANCIAL PLANNER™ at Watchdog Capital. He has a passion for traditional finance and Bitcoin, and is eager to see how the two worlds interact with each other.