In late 2020, the SEC began reforms on its exempt offering framework.

Recent changes to exempt offerings include increasing Tier 2 of Regulation A to $75 million from $50 million, and increasing Regulation Crowdfunding from $1.07 million to $5 million.

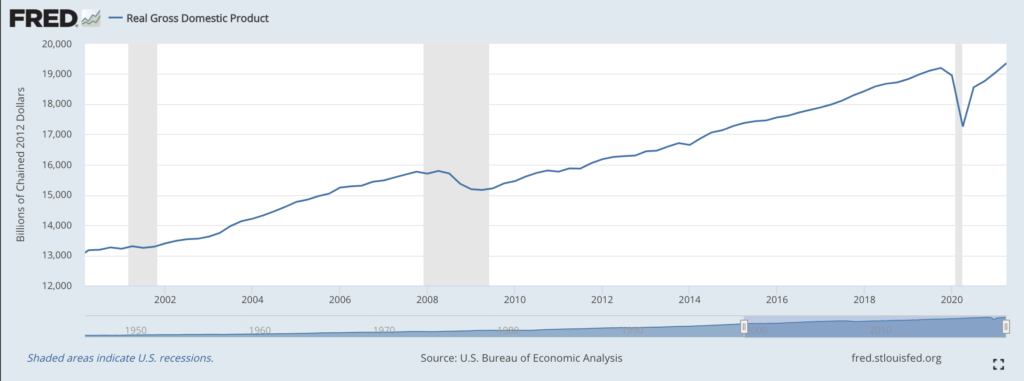

Throughout the COVID pandemic, businesses were hit hard, and many were destroyed all together. The economy was rattled by lockdowns and has taken longer than anticipated to get back on its feet.

As businesses strive to rebound, the updated “patchwork” of the exempt offerings framework facilitates growth and enhances the creation of capital.

What are Exempt Offerings & what changed?

Exempt offerings are transaction exemptions companies may use to offer and sell securities without having to register said transactions with the SEC.

Regulation A, in particular, is an exemption from registration for public offerings, and allows for companies to offer and sell securities without registering with the SEC.

If a company does not meet an exemption, offers and sales of securities must be registered with the SEC under federal securities laws.

Under regulation A, companies can fall under two offering tiers: Tier 1, exemptions of offerings up to $20 million in a 12-month period, and Tier 2, exemptions of offerings up to $75 million in a 12-month period.

Previously, companies filing under Tier 2 were permitted to raise up to $50 million in any 12-month period, with no more than $15 million of this limit from any selling security holders who are affiliates of the issuer. In contrast with Tier 1 offerings, offering statements under Tier 2 do not need to be qualified by state securities regulators and issuers must file an annual report with form 1-K.

In addition, outside of Regulation A, the SEC increased Regulation Crowdfunding from $1.07 million to $5 million and Rule 504 offerings to $10 million, as well as revising some individual investment limits.

Regulation Crowdfunding is now one of the only ways non-accredited investors can invest in private companies, which levels the playing field within VCs and billionaires.

Raising the offering limit is likely to attract issuers and institutional investors who bring more funding and experience to the market, which will help to create stronger foundations for businesses emerging out of the rubble from COVID.

Economic Impacts of COVID

The COVID pandemic rattled the global economy, leading to the massive destruction of businesses and the aggregate economy these businesses make up.

In Q2 of 2020, real GDP fell by 9.5%, the highest recorded drop in U.S. history.

Consumer spending also fell by its most drastic rate, down by 12.6% in April as lockdowns put a screeching halt to spending outside of the household.

Unemployment hit a peak of 14.8% in April of 2020, with jobless claims soaring over one-million per week for months after.

The Federal Reserve injected trillions of dollars into the money supply in an attempt to spur fiscal growth, while billions of dollars in stimulus spending was rolled out to aid struggling Americans.

Despite the Fed’s bolstering of M2, a complete lack of spending by consumers put deflationary pressure on the economy, and inflation remained near 0% from March to May of 2020.

As lockdowns have lifted and vaccines continue to roll out, we are rapidly entering a recovery phase where business creation is crucial to future growth and recovery.

Macroeconomic Outlook now

The return to normal has spurred spending and growth, but not to the extent that many had speculated.

Employment is yet to rebound to pre-COVID levels and is currently at 5.9% as of the June 2021 BLS report.

Both the Federal Reserve and President of the United States have made it clear that returning to full employment is of utmost importance, and the Fed has pledged to continue with loose monetary policy until “substantial further progress” is made, and employment reaches the 4.5% rate it was at pre-pandemic.

The Fed also anticipates that real GDP will grow by 7% for the whole of 2021, before settling at 2.4% by 2023.

And in terms of inflation, the deflationary pressures we saw last summer have subsided, and inflation is running hot as consumers hit the market ready to return to spending outside of the household.

Despite June’s year to year CPI growth of 5.4%, the Fed still expects inflation to settle at 3.4% this year with core PCE inflation expected to hit 3% before dropping to 2.1% in 2022 and 2023.

Outside of what’s measured by the CPI, prices have begun heating up. While lumber prices saw their peak this spring and are expected to continue falling, other commodities such as oil are facing significant supply constraints that are driving prices up.

Last week, markets reflected Hawkish sentiment as the Fed’s updated dot plot showed the potential for two interest rate hikes in 2023. Fed Chairman Jerome Powell was quick to shrug off the dot plot, claiming that there is no good indicator for what the Fed will do with interest rates until the economy achieves substantial growth.

Meanwhile, the Fed announced that it will not begin the tapering of asset purchases and will continue to buy at least $80 billion per month of treasury securities and at least $40 billion per month of agency mortgage-backed securities until employment goals are met.

All in all, surging prices and an expansionary Fed could lead to an overheated economy that is producing at an unsustainable level. What happens in the fall in terms of labor and consumer spending will be crucial in whether or not we see overheating.

How Exempt Offerings help

As I mentioned above, a majority of companies depend on private offerings to raise capital.

The companies most affected by exempt offerings aren’t the large corporations that receive billions in bailouts from the Federal government – exempt offerings are of utmost importance to small, local businesses who are often overlooked by the Federal government.

Small and local businesses make up the backbone of the middle class, and exempt offerings are allow for issuers and investors alike to build wealth.

On an aggregate scale, capital markets rely on exempt offerings.

In the United States, companies raise more than double the amount of capital from private offerings than registered public offerings.

In March of 2020, the SEC released data on offerings from 2019, showing that exempt offerings accounted for $2.7 trillion of capital raised compared to $1.2 trillion raised by registered offerings.

Exempt offerings act as an alternative to IPOs and are a credible source of capital to fund growing businesses.

Currently, the growth of emerging businesses is crucial for recovery. Capital creation is facilitated when regulation is simplified, and businesses are allowed more leeway in the amount of unregistered offerings they can accept.

Reforms to exempt offerings allow for businesses to expand their growth and potential impact in the market in a “natural” way that avoids the harms of government fiscal intervention through means of injecting dollars into the economy.

Where to go from here

Regulation can be complex.

If you don’t have a law degree or experience within the field, understanding new changes and how they affect you can be quite the challenge.

Luckily, there are plenty of organizations that stand ready to help with information and legal assistance along the way.

Companies like Watchdog Capital (an SEC registered broker-dealer) help to bridge the gap between the worlds of established securities and digital financial technologies and stand ready to help with anything from underwriting and fundraising to advisory services and securities transactions.

Like I mentioned earlier, facilitating offerings to small and local businesses is important for the health of the economy and allows for the middle class to grow their wealth.

As a securities offering platform, Watchdog Capital also helps to match investors with opportunities, and facilitate exempt securities offerings, designed to help issuers find the right investors for their raise and to help investors find opportunities that align with their goals.

In addition, there are a variety of resources available online, from D.C. based policy centers and think tanks that strive to inform the community on relevant industry changes.

As regulatory constraints hit the financial services industry, it is important now more than ever to stay aware and informed of changes to regulation and how they can impact you and the industry as a whole.

*All data and charts sourced from FRED, fred.stlouisfed.org

We are currently registered and able to conduct business in all 50 states, Washington DC, Puerto Rico and the Virgin Islands. We are permitted to conduct business and work with clients only within the states and territories where we are registered.

Check the background of Watchdog Capital, LLC and your investment professional on FINRA’s BrokerCheck

Legal & Disclosures / Customer Relationship Summary / FINRA BrokerCheck

Important Disclosure: Securities and investment banking services offered through Watchdog Capital, LLC, a registered broker-dealer and FINRA/SIPC member.

Watchdog Capital, LLC

850 Pacific Street, Suite 1151 / Stamford, CT 06902

Direct 678-679-8635